AI-Powered Insurance & Treatment

Validation at the Point of Sale

HIPAA-Compliant, AI-Augmented Insurance Verification at Scale

We developed a high-performance backend system for a healthcare insurance

company that enables pharmacies to instantly verify whether a customer is

eligible for insurance compensation when purchasing medication. In addition to

implementing the industry-standard NCPDP protocol, we introduced a dedicated AI

layer that enhanced safety checks, optimized medication workflows, and automated

critical decision-making processes.

Download PDFBusiness Challenge

A leading healthcare insurance provider set out to build an in-house platform for real-time insurance coverage validation at the pharmacy point of sale. The goal was to streamline operations, reduce dependency on legacy systems, and ensure safer, smarter decision-making.

Technical Challenge

To meet this goal, the solution had to:

To meet this goal, the solution had to:

Analyze currently prescribed medications in real time to detect combinations that may conflict or result in severe adverse effects

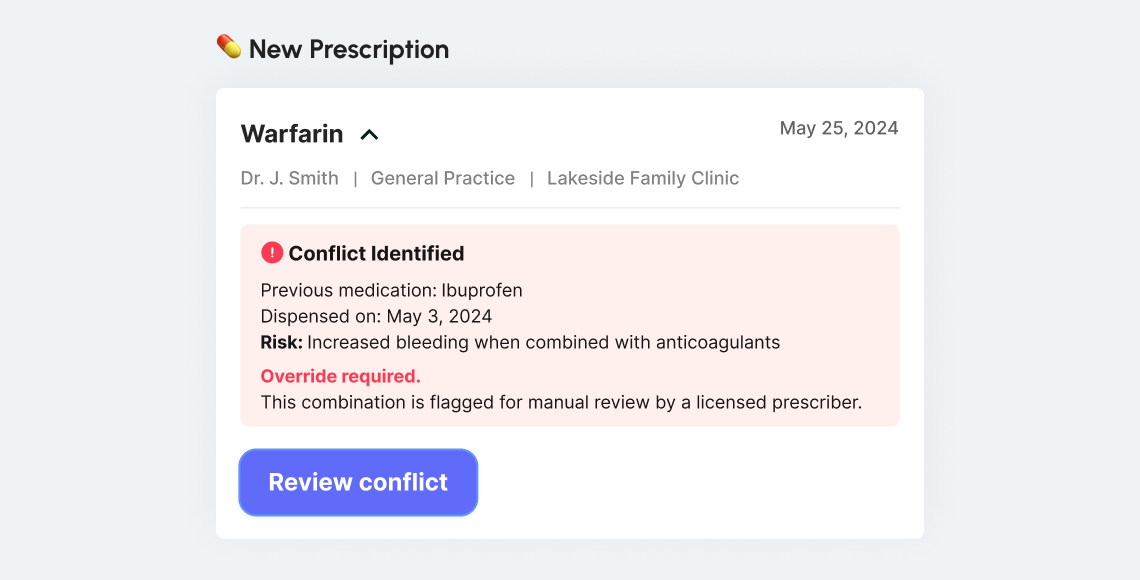

Offer real-time safety net logic that could act on behalf of the insurance company with no human intervention

Fully implement the NCPDP standard for pharmacy benefit verification and claims

Ingest structured medical and insurance data to assess eligibility in <100ms

Leverage AI to evaluate patient history and detect treatment contradictions

Large transformer models like GPT or BERT were ruled out early due to latency, cost, and lack of deterministic behavior.

Choosing the AI

| Model Name | Architecture | Usage Purpose | Limitations in This Use-Case |

|---|---|---|---|

PharmaExplain-GPT | GPT-4 (Generative Transformer) | Generate explanations for medical coverage | Too slow (>500ms latency), non-deterministic, high infra cost |

FeedbackParse-BERT | BERT-style Transformer | Extract issues from patient complaints | Text-focused, unsuitable for structured, real-time pharmacy data |

RxSequence-RNN | GRU-based RNN | Analyze treatment sequences for risk | Irrelevant sequential logic for point-based medication checks |

CoveragePredict-LGBM | LightGBM | Predict insurance approval outcomes | Fast and interpretable — base for our chosen approach |

RoutePharma-AI (Chosen) | XGBoost + Rule Engine | Real-time eligibility + treatment conflict detection | Ultra-fast, explainable, deterministic — selected solution |

We chose XGBoost + Rules to ensure real-time decisioning, compliance-grade explainability, and deterministic output — all essential in the insurance-pharmacy workflow.

Tech Stack

Go

![[object Object]](/images/common/tech/aws.svg)

AWS

(ECS, Fargate, Lambda)

(ECS, Fargate, Lambda)

PostgreSQL

NCPDP Protocol

XGBoost

![[object Object]](/images/common/tech/drools.png)

Rule Engine

(Drools)

(Drools)

![[object Object]](/images/common/tech/onnx.png)

ONNX Runtime

(planned for NLP extension)

(planned for NLP extension)

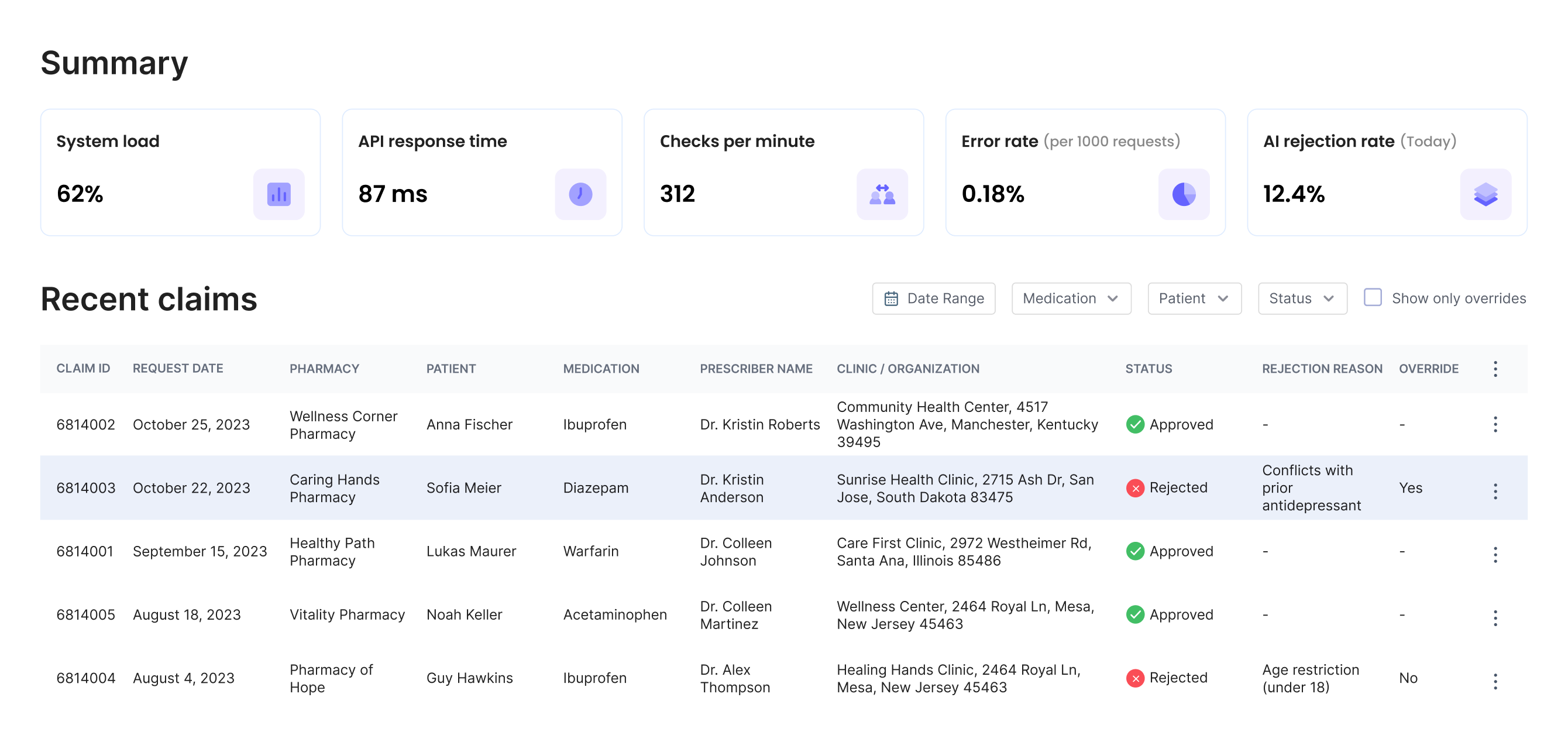

Insurance Coverage Engine (NCPDP Protocol)

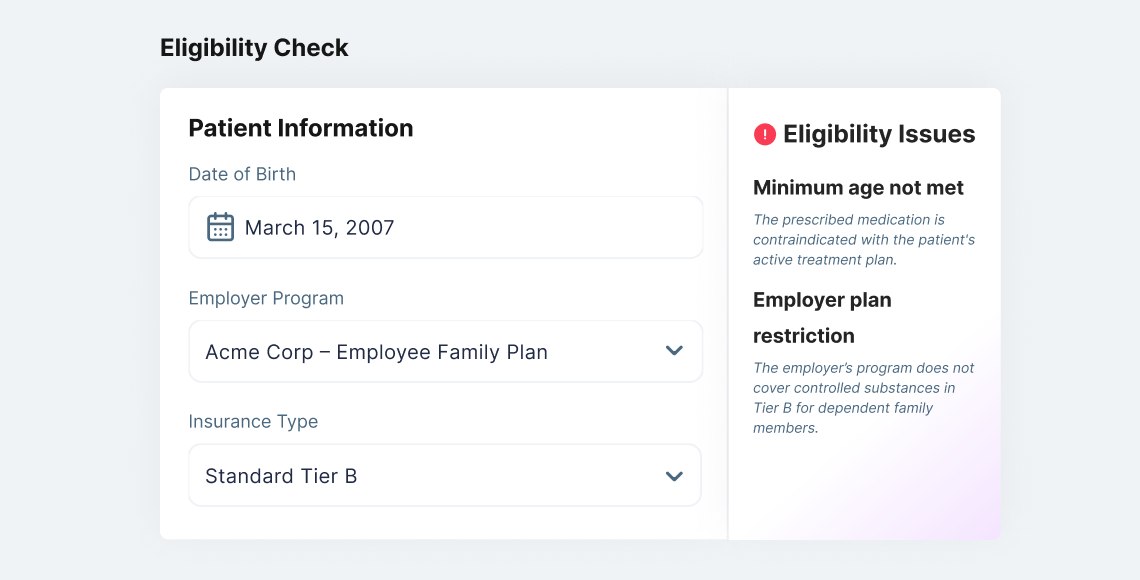

Parses input related to the patient, employer, and dependents

Validates eligibility using NCPDP message flows and real-time insurer queries

Returns precise approval/denial status for requested medications

AI Treatment Intelligence Layer

Built around a custom XGBoost model + rule engine, this layer provides:

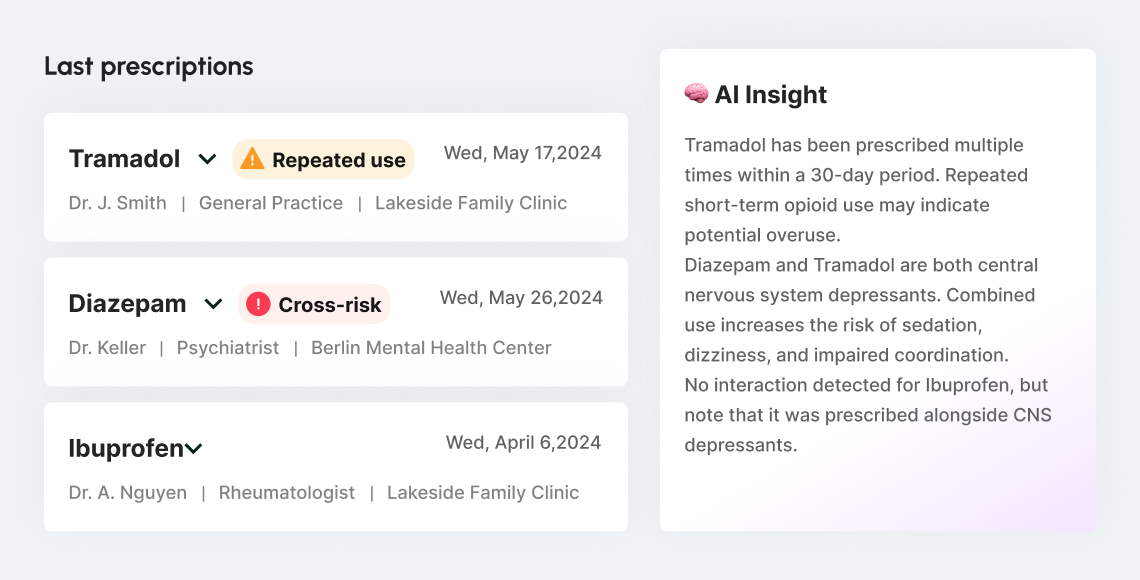

Historical Prescription Analysis:

AI examines past purchases to detect recurring risks or cross-medication dependencies

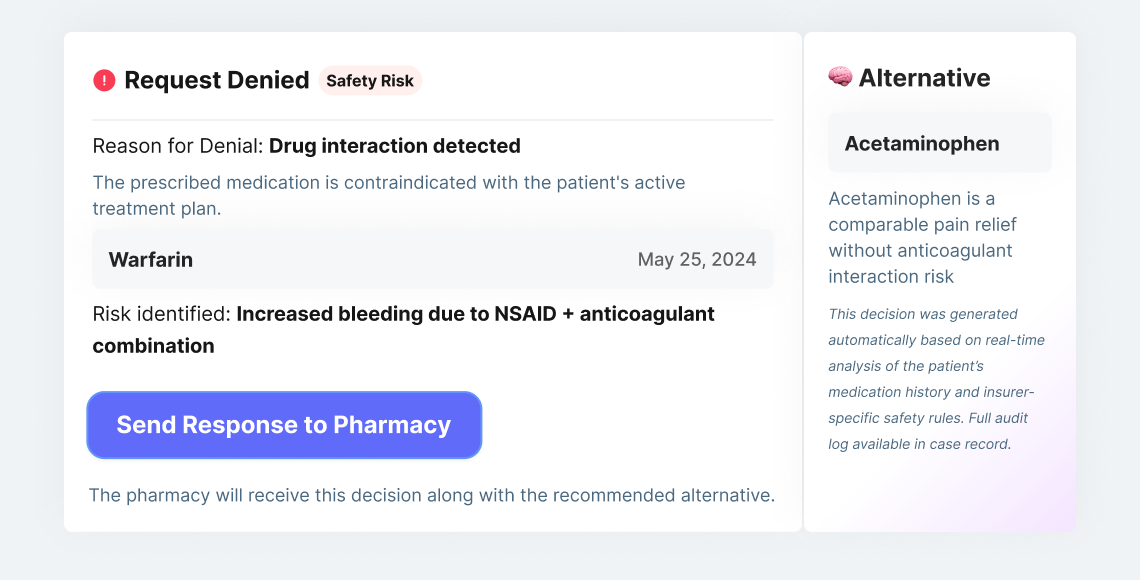

Interaction & Override Detection:

Identifies when current prescriptions cancel out or conflict with prior treatments

Why AI Was Introduced?

Originally, the platform operated on a deterministic rule-based engine that handled eligibility decisions: full approval, rejection, or partial coverage. These rules were based on policy parameters and clinical safety protocols.

However, over time, internal operations teams began to observe edge cases that rules alone couldn't address:

1.

Brand overlap

Patients purchasing medications with the same active substance but from different brands — triggering accidental overdose risks

2.

Conflicting prescriptions

Patients consulting different doctors and receiving treatments that canceled each other out or posed serious health risks

3.

Ineffective combinations

Cases where medications didn’t interact dangerously, but reduced each other's effectiveness, making treatment pointless

4.

Excessive strain

Multiple prescriptions in parallel creating unnecessary physiological load on the patient

Initially, these cases were flagged manually by care managers based on patient history and insurance claim patterns. This led to the realization that historical and contextual analysis could not be fully captured through static rules alone.

To address this:

AI was first introduced as an assistive tool — flagging potential conflicts for human review based on patterns found in historical prescription data.

As confidence in AI accuracy grew, and it consistently aligned with expert reviews, the model was gradually integrated into the live decision-making pipeline.

Today, it functions as a core part of the response logic — complementing the rule engine by adding contextual awareness, risk detection, and dynamic validation of new prescriptions

The result: smarter automation that can detect real-world clinical risks, not just policy violations — all while maintaining real-time performance.

Impact

<100ms response time

for insurance + safety validation80% fewer treatment conflicts flagged

due to AI-driven prescription intelligenceExpanded eligibility support

for employee family members via structured policy rules100% explainable outcomes

fully auditable for compliance and regulatory reviewMillions of prescription events processed

with zero downtime or manual approval fallback

Get in touch

To discuss your development needs

Attach files

Send me an NDA

Attach files

or drag & drop files here

Send me a SiliconMint NDA

Send