Real-time lender case study

Moving billions in loan origination to the cloud

The challenge

Business

The business challenge was to examine existing systems and devise a plan for how to iteratively re-implement key origination and servicing parts of the software while maintaining 100% uptime in both originating new loans and servicing existing loans, both online and via a dedicated call center in Ipswitch, UK.

Technical

The technical challenge was to re-architect a legacy system for the modern cloud era where microservice architectures provide reliability, scalability, and flexibility in delivering new products and services.

A key aspect was that the software rewrite and re-platforming to the cloud had to be done in an iterative fashion, keeping the existing system carefully in place during the entire 21-month migration and re-implementation process.

A key aspect was that the software rewrite and re-platforming to the cloud had to be done in an iterative fashion, keeping the existing system carefully in place during the entire 21-month migration and re-implementation process.

Advisory services

SiliconMint performed a full assessment of existing digital technologies and provided a reference architecture for moving to a modern cloud-native architecture.

Technical implementation

SiliconMint re-implemented the entire loan origination stack in a modern .NET microservice architecture on the Microsoft Azure cloud.

Human capital & velocity

SiliconMint optimized the human velocity of software delivery at the UK lender by delivering a continuous delivery mechanism via Azure DevOps and trained staff at the lender on best practices for usage.

SiliconMint builds a cloud-native lending system

Application architecture and implementation

A monolith PHP application, which handles billions in originated loans, was iteratively reworked into a modern set of C#/.NET microservices without disrupting business operations.

Cloud migration

On-premise operation of the loan origination software was moved to the Azure cloud, being careful to leverage mature Azure services while avoiding those which pose cloud vendor lock-in or Azure service maturity risk.

Reworked human processes: continuous delivery

Both technical and human processes were reworked to increase the velocity of software delivery within the UK real-time lender. This included the design and configuration of continuous integration and continuous delivery pipelines in the Azure DevOps service.

21 months

Over the course of 21 months, SiliconMint engineers carefully re-implemented, tested, deployed, and verified the new loan origination application user experience and backend service in the Azure cloud.

Billions in disbursed loans

Included in the rebuilt systems was the Payment Gateway Service, a system built by SiliconMint to handle all loan disbursement and installment payment collections.

Net positive impact

With the migration to .NET microservices on the Azure cloud in place, the lender is working to deliver new products to improve the lives of UK residents.

Crafting the user experience

The user experience for the loan application was carefully crafted by taking into account brand guidelines and optimized by hand for fast page load times and user interaction at key points within the application flow. As a result, usage of the new interface has consistently beaten and exceeded the legacy system it replaced.

Loan origination in the cloud

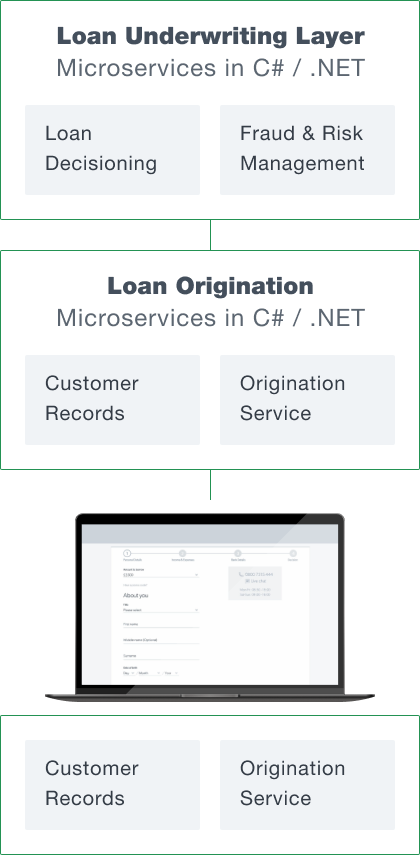

Loan origination + underwriting

C#/.NET Microservices

C#/.NET Microservices

The loan origination system was comprised of numerous C# microservices, with each one handling an aspect of the loan origination process (handling the loan application, working with existing customers, interacting with the real-time decisioning engine, thus creating as a whole the system of record for managing applications and funded loans).

Loan application user interface

Angular/TypeScript

Angular/TypeScript

Several front-end frameworks were evaluated (React, Angular, Vue), and Angular was chosen for its stability and bundled framework-level functionality.

The loan application user experience for consumers was rewritten completely from scratch, taking into account brand guidelines and support for multiple languages within the European Union. Due to additional reseller arrangements between the UK lender and 3rd party financial organizations, support for crafting a white-label experience was also built into the very core of the front-end application. As a result, the lender seamlessly operates the newly built loan application user interface under multiple brands.

The loan application user experience for consumers was rewritten completely from scratch, taking into account brand guidelines and support for multiple languages within the European Union. Due to additional reseller arrangements between the UK lender and 3rd party financial organizations, support for crafting a white-label experience was also built into the very core of the front-end application. As a result, the lender seamlessly operates the newly built loan application user interface under multiple brands.

Payment gateway system by SiliconMint

Real-time payment gateway system

The payment gateway system (PGS) was built in C# on the new .NET Core platform and deployed in a containerized fashion to multiple worker nodes for failover and resiliency. PGS today handles all loan disbursement by interfacing with external payment networks within the UK, and in 2020 will support the additional requirements imposed at a country level to comply with the PSD2 standard.

Reliability, scalability, availability

The payment gateway system (PGS) was architected by SiliconMint to be reliable, scalable, and fault-tolerant. As a result, PGS will survive the failure of multiple nodes where it is executing, the outage of external providers, and numerous other corner case scenarios.

Load testing was performed to ensure that PGS will withstand the load at the lender for years to come, with current uptime in production measured at nearly 100% in the past 12 months of operation.

Load testing was performed to ensure that PGS will withstand the load at the lender for years to come, with current uptime in production measured at nearly 100% in the past 12 months of operation.

Cloud

In 2004, SiliconMint principals started using the Amazon cloud (AWS EC2 & S3) to create distributed services in Palo Alto, California. Having witnessed the evolution to multiple clouds including Azure and Google Cloud Platform over the course of 15 years, SiliconMint has the expertise to provide deep advice on cloud architecture and migrations.

Software architecture

Since 1999, SiliconMint principals have built software for embedded oil pipelines, buildings, trains, online stock brokerages, lending providers, and the insurance sector. By witnessing (and often predicting) software trends over a long period, SiliconMint staff provide an experienced, even-keeled hand when suggesting technical architecture. This keeps a customer's best interests (timely delivery, de-risking vendors, maintainability & supportability) at heart.

User experience

Since the 1990s, SiliconMint principals have been involved in the construction of tooling to improve how user experiences are conceived. This relentless focus on not only a great user experience but the tooling behind it gives SiliconMint an edge in understanding what drives user behavior on the web.

Get in touch

To discuss your development needs

Attach files

Send me an NDA

Attach files

or drag & drop files here

Send me a SiliconMint NDA

Send